The Millionaire’s Mindset

Exactly what is the difference between the wealthy and the rest of us? It’s not only about how much money rich people have compared to the rest of us, or even about the luxuries they enjoy. It’s a matter of perspective for them.

In a short period of time, many people who have won large sums of money have returned to their pre-winning status. They’ve lost all of the money they’ve earned in the past. They are few and few among those who can maintain their wealth long enough to raise their standard of living.

Why? Because wealth isn’t based on money or a lavish lifestyle. It’s a matter of perspective for them.

Real millionaires and billionaires are extremely different when it comes to how they handle their money and their possessions. And the reason for this is that they were born with a different way of thinking than the majority of the population.

Let’s take a look at this from the perspective of the common person…

Average folks would go shopping as soon as they could get their hands on a huge large cheque. Spend the money on a brand-new automobile, a fancy home, or a once-in-a-lifetime luxury vacation. Or all three.

A lot of individuals think it’s necessary to have everything a millionaire has, travel to locations a millionaire would go, and drive cars that a millionaire would own in order to be truly wealthy.

They can afford it all because they have a lot more money to spend. While most of us would consider ourselves wealthy if we had all the above, we’d be wrong. The idea that we can become affluent by “acting” or “living” like people who already are is ingrained in our minds.

Despite this, if we want to get rich, we have to think like the rich.

Again, I must stress the importance of having a positive outlook on life. It’s not what they own or how they spend their money that’s the problem.

Most of us go shopping with the belief that if we buy now, we won’t have to struggle later.

In the minds of the wealthy, shopping is a time-delayed event: Put it off now, save it, and enjoy it later! They are fans of putting off gratification until later.

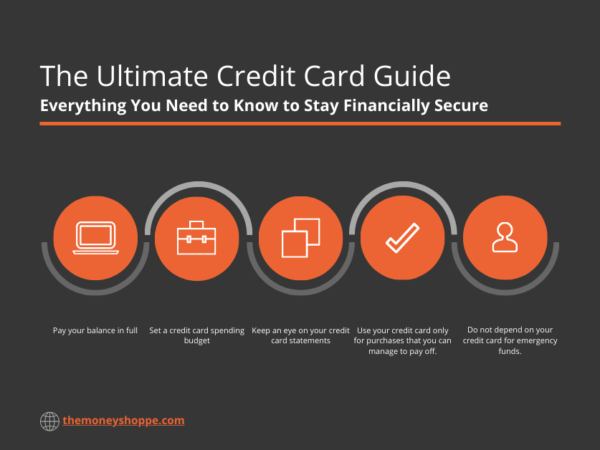

As a result of their reliance on quick satisfaction, most individuals would wind up in debt. And in the majority of situations, their financial situation worsens. Loans for automobiles, furniture, school, mortgages, and credit cards, to name a few.

With each passing chapter, the story becomes more and more familiar to the audience as a whole. Because of their debts, they became “slaves of their own jobs” in order to pay them off.

Instead of being a choice, a job becomes a necessity for these people. It’s picked based on how much money they’ll need to pay off their debt rather than how much they’ll like their work.

Is it possible for them to retire early? No. Actually, they’d rather not consider it! They can’t afford to stop paying their debts, so they can come and go as they please.

The wealthy, on the other hand, are aware of both the disadvantages and the positives of being debt-free. They are able to save more money because they are debt-free.

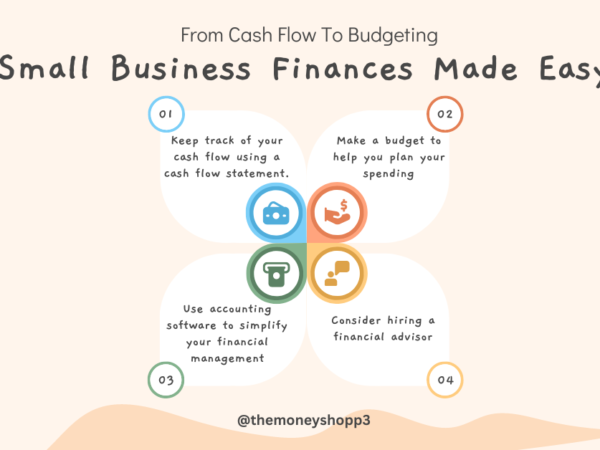

People who are well-off have the means to put more money into their own firms. It is these firms that provide them with a lifelong source of passive income, and they own them. For decades, the truly wealthy have realized that regular employment will never lead to wealth. Their bosses would be very wealthy as a result, but exchanging time for money will never lead to real wealth.

Is it possible for business owners to retire early? Yes. Having your own business implies that you’ll never have to worry about running out of money (more likely even longer than that). With constant effort, you will eventually reach a point in your business where your passive revenue outweighs your daily expenses.

In the event that this occurs, you have the freedom to work when, where, and how you like. Money isn’t going to be a limiting factor in your career choices. A job would not be an obligation for you, but rather an option. Even if you decided to stop working, your business would continue to bring in money for you.

Real freedom is like this, and this is exactly how the rich think!

As a matter of fact, the idea of investing in a business has been treated with derision by certain people. Investors are often stereotyped as having an unhealthy obsession with money as if they’re enslaved by it.

The general public believes that business owners’ success is the result of their own avaricious, self-centered motivations. Many people believe that company leaders must be slaves to their money and fortunes in order to have so much money at this point in their life.

The truth is that they have the exact opposite frame of mind.

To begin with, business entrepreneurs started their companies for purely selfish reasons.

They are able to spend quality time with their loved ones because they have their own businesses that create passive money for them.

To attend their daughter’s first dance recital or their son’s birthday celebration, they are not too busy.

Taking a one-week vacation with their spouse isn’t a big deal for them. They are not too busy (or financially strapped) to participate in charitable action.

A typical worker, on the other hand, would be unable to take a vacation whenever he wanted to. Neither his daughter’s nor son’s 6th birthday parties are possible due to his hectic work schedule. To top it all off, he’s too busy (and broke) to undertake any sort of volunteer social work. He’s looking for a career that pays well, and social work isn’t going to cut it.

Who’s the narcissist now?

Finally, affluent people reveal themselves to be more selfless than the normal person since they own enterprises that create a steady stream of money for them and their families for generations to come.

Typical workers will either retire broke or die penniless, leaving their families with nothing (if not their debt).

For those who have the appropriate perspective, they can have an abundance of riches as well as the opportunity to live abundantly: spend quality time with loved ones, do all the things that make you happy, and use their wealth to assist others and make the world a better place.

Having the appropriate perspective will allow you to care for and provide for your loved ones after your death.