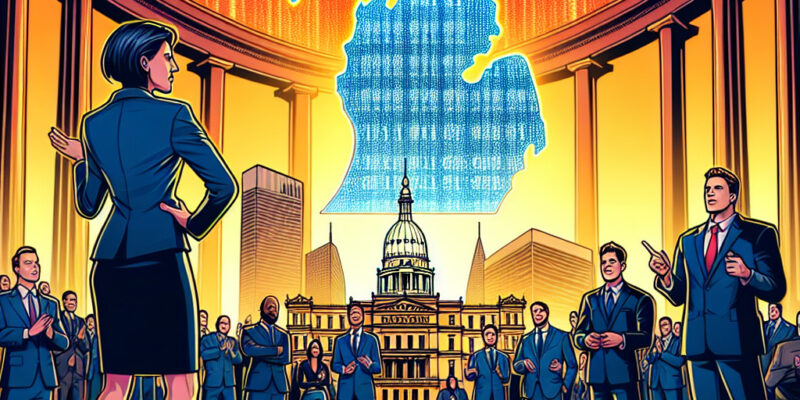

Michigan Advances Bold Crypto Investment Bill to Boost State Economy

In an unexpected move that could redefine how state funds are allocated, Michigan is contemplating a daring shift towards digital finance. The proposal on the table is a bill that paves the way for the state to potentially invest up to 10% of its funds in digital currency. If successful, this initiative could place Michigan at the forefront of a growing trend where traditional finance intersects with innovative cryptocurrency investment.

The bill, which recently advanced to the crucial committee stage, aims to diversify the state’s financial portfolio by introducing cryptocurrencies as a viable investment option. This step is monumental considering the cautious approach many other states still maintain towards digital currencies, largely due to their notorious volatility and regulatory uncertainties.

At the heart of this initiative is the broader vision of fortifying Michigan’s economic landscape. Lawmakers and advocates of the bill argue that digital assets might offer a fresh avenue for growth—one where significant returns are possible, albeit with proportionate risks. This perspective reflects a growing recognition of cryptocurrencies’ potential to serve as hedges against traditional market downturns, perhaps even insulating state funds from fiscal slumps.

The global financial landscape is evolving rapidly, with many governments and institutions experimenting with blockchain technologies and digital currencies. Michigan’s potential embrace of crypto is a clear signal that states are beginning to understand the importance of being part of this digital revolution. Embracing such innovations could also spark an economic renaissance, attracting tech-savvy talent and investors looking for forward-thinking regions to support.

Yet, it’s not all clear skies and certainty. Cryptocurrencies remain a polarizing topic, primarily due to their profound market fluctuations. Take the infamous 2017 Bitcoin surge as a cautionary tale—it skyrocketed to nearly $20,000 before crashing, leaving many skeptical of its stability. Despite this, the crypto market has matured significantly since then, with more robust infrastructures and regulatory frameworks slowly taking shape. However, the high-risk nature of cryptocurrencies necessitates thorough scrutiny and strategic approaches, especially when public funds are at stake.

As the bill journeys through the legislative process, various stakeholders, including financial analysts, technological experts, and political figures, will weigh in. Their perspectives will likely shape the contours of the bill, ensuring that the state’s foray into the crypto world is both calculated and informed. Dialogue around this bill could also spark more extensive discussions about the future of digital currencies in public finance, potentially influencing similar initiatives nationwide.

Reflecting on the potential enactment of this bill, one can’t help but consider the broader implications for both Michigan’s economic vitality and the nation’s financial future. Could this be a precursor to other states reassessing their stance on digital investments? Michigan’s bold step, while laden with uncertainties, signals a refreshing willingness to innovate and adapt—an attitude that might well echo beyond its borders.

In a landscape where technological advancement and finance are increasingly intertwined, Michigan’s exploration of digital assets not only invites a new chapter in state economics but also provokes a wider contemplation on how we define and secure economic resilience in the digital age.