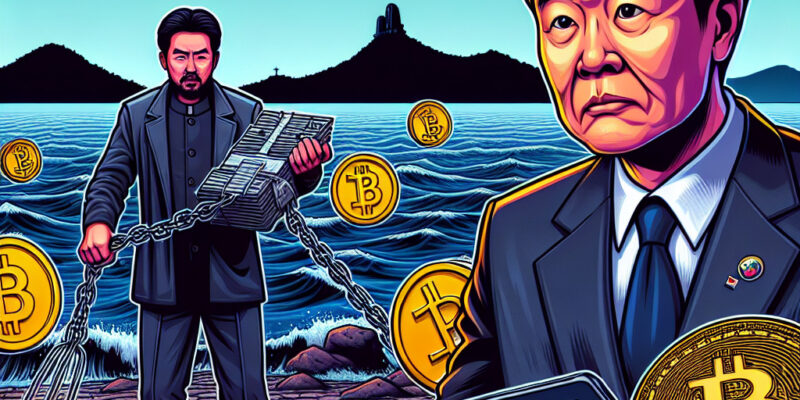

Jeju City Cracks Down on Crypto Tax Evaders: Seizures Begin Now

In an unexpected yet decisive move, Jeju City in South Korea has commenced a stringent action plan against individuals suspected of dodging taxes, specifically targeting their cryptocurrency assets. This initiative is part of a broader effort by the South Korean government to tighten its grip on tax compliance, particularly in the ever-evolving digital currency space. The local authorities are now vested with the power to seize cryptocurrencies from those accused of tax evasion, a development following legislation passed in 2021.

When the South Korean lawmakers introduced these regulations two years ago, it marked a pivotal point for the nation’s approach to digital assets. These laws were designed to empower regulators with the necessary tools to ensure tax laws are adhered to, even when financial transactions are conducted in the uncharted territories of cryptocurrencies. It was a proactive measure, aimed at closing the proverbial loopholes that allowed potential tax avoidance through the use of digital currencies, which operate outside traditional banking systems.

The newfound authority to seize digital assets forms a critical part of this legislation. For many, cryptocurrencies represent a double-edged sword: a world of financial opportunities on one hand and a field ripe for regulatory challenges on the other. It’s a space where anonymity can easily be leveraged for avoiding fiscal responsibilities, thus making regulatory oversight crucial. South Korea’s actions underscore the importance of adapting tax law enforcement strategies in response to modern financial instruments.

For Jeju City, an island known for its unique administrative policies and vibrant tourism industry, this crackdown signifies a serious message to residents and businesses alike: compliance is not optional. The city, often viewed as a testbed for new policies in South Korea, is setting a stern precedent in its commitment to upholding fiscal integrity. Its decision to execute these seizures reflects a broader, national mandate to root out tax evasion schemes wherever they may hide, even in the digital wallets of crypto users.

Globally, governments are grappling with how to effectively regulate cryptocurrencies. While some nations have chosen to embrace and regulate, others remain wary, adopting a more cautious approach. However, the apparent anonymity provided by digital currencies has often presented obstacles in tracing ownership and value, making it a fertile ground for evading taxes. Jeju City’s efforts are a reminder that regulatory bodies are increasingly equipped—or are equipping themselves—to meet these challenges head-on.

In the coming months, it will be interesting to observe how these enforcement actions unfold and the potential ripple effects they may have on both the local and national levels. For residents and digital asset holders in Jeju City, this initiative is undeniably a wake-up call to ensure their tax affairs are in order. Not only does this crackdown affirm South Korea’s commitment to regulatory enforcement, it also serves as an invitation to other regions to consider how they might address similar challenges in their jurisdictions.

As the landscape of digital finance continues to evolve, the balance between innovation and regulation remains ever delicate. Jeju City’s recent actions serve as a potent reminder of the constant vigilance required to maintain this balance. It’s a dynamic that will surely continue to shape the discourse surrounding cryptocurrencies and regulation on a global stage.

In the midst of all these developments, one might reflect on the broader implications for digital asset holders worldwide. How will such regulatory actions influence the perception and adoption of cryptocurrencies? As policymakers and technologists ponder these questions, individuals may do well to stay informed, vigilant, and prepared for the shifts that the future may bring. Whether this marks a turning point in the regulatory landscape or a mere stepping stone, only time will tell.