India Launches RBI-Backed Digital Currency, Shunning Unsupported Crypto

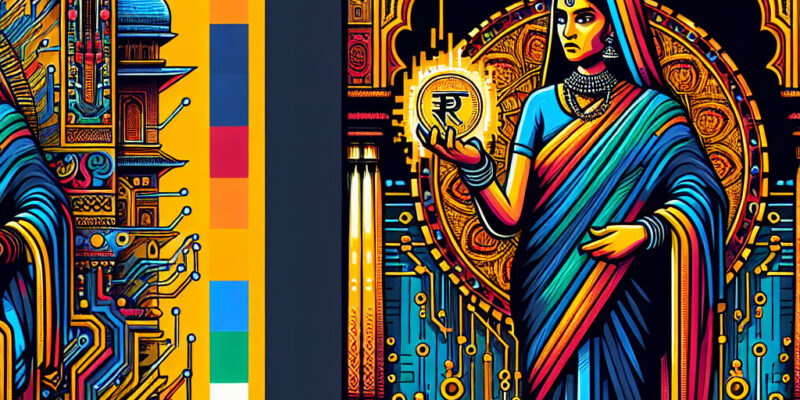

In a move that could significantly reshape the landscape of its financial system, India is embarking on a bold journey by introducing a digital currency controlled and issued by its central bank, the Reserve Bank of India (RBI). This state-backed digital currency represents the country’s decisive shift in strategy from a previously passive approach to a more regulated and structured engagement with digital money.

For India, this development marks a departure from its earlier, somewhat laissez-faire policy toward cryptocurrencies. Until now, the government enacted a “tax-and-tolerate” policy, which, while obtaining some revenue from crypto transactions through taxation, essentially allowed these virtual currencies to operate in a largely unregulated space. Analysts believe this approach was unsustainable for a country of India’s size and complexity, where financial stability and security are always on the front burner.

The introduction of the central bank digital currency (CBDC) appears to be a calculated response to several pressing challenges and aspirations. In the existing scenario, cryptocurrencies like Bitcoin and Ethereum operate beyond the realm of state control, posing potential risks to economic stability and facilitating illicit activities due to their anonymity and lack of regulation. By establishing a CBDC, India is not only seeking to mitigate these risks but also to harness the myriad benefits of digital currencies in a secure, state-controlled manner.

From a broader perspective, this move could have profound implications for the Indian economy. By endorsing a digital currency that is backed by the state, India is aiming to increase the efficiency of its monetary system, reduce the cost of paper money production, and enhance the speed of transactions. Such an initiative aligns with global trends where several countries are exploring, or have already introduced, their own digital currencies. For instance, China has been a frontrunner with its digital yuan, actively integrating it into its monetary system.

The implementation of a digital rupee also opens doors for greater financial inclusion, especially in a diverse country like India, where millions still remain unbanked. Digital currency could potentially bridge this gap by providing easier access to financial services for its extensive population. This potential for fostering inclusivity is one of the most compelling aspects of CBDCs, and it is a key motivator behind India’s shift.

However, the transition to a digital currency landscape is not without its challenges. Concerns about privacy, data security, and the impact on traditional banking need careful consideration. The government and RBI will have to navigate these complexities with a robust regulatory framework that protects individuals’ rights while promoting the broader adoption of the digital rupee. Moreover, the existing crypto enthusiasts and businesses who have thrived under the less regulated environment of private cryptocurrencies may find this shift challenging.

In this unfolding narrative, India is poised at the cusp of a transformative journey. The launch of the RBI-backed digital currency is more than just an economic or technological change—it’s a reflection of India’s evolving vision for its future financial ecosystem. As the digital rupee begins to take shape and gain momentum, it invites a myriad of questions about the balance between innovation and regulation, privacy and transparency, competition and control.

As individuals and businesses alike adapt to this new digital frontier, the conversation will undoubtedly evolve. It will be intriguing to watch how India, with its vast cultural and economic diversity, navigates the complexities of integrating a state-backed digital currency into its society. There will be lessons learned, challenges faced, and successes celebrated, all of which will contribute to the global discourse on digital currencies. Whether you are an enthusiast or a skeptic, there’s no denying the significance of this development. As this story unfolds, we are reminded that we’re witnessing not just a financial transformation, but a historical moment in India’s journey towards a digital future.