How to Make the Most of Your Money

I’m always surprised by how many people spend most of their lives at work and don’t care about anything else.

Many of the business people I work with want to get their work lives in order, but they admit that their personal lives are a mess.

They don’t have any plans for how to handle this very important area. The papers for the house are not in order and are piled up in a corner of the house. They don’t know where their money goes and usually don’t have a plan for their financial future.

If you don’t get your own life in order, you won’t have much to look forward to in the future.

Don’t say you’re too tired, you don’t have time, or you don’t know how.

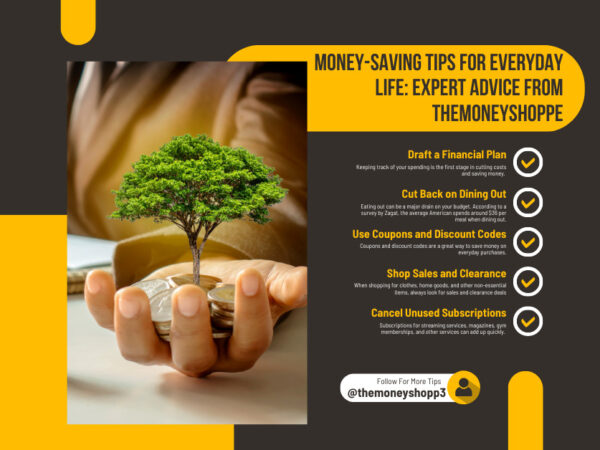

Here are a few ideas to help you get started:

- Set up a system for filing your papers.

- Sort your papers into different piles, like “Bank,” “Car,” “Children,” “Home,” “Medical,” “Insurance,” “Investments,” “Taxes,” “Utilities,” etc.

- Organize direct debits for regular bills.

- Every day, you should read, sort, and act on your mail and emails. This will keep things from getting worse.

- When you need to remember to do something, write it in your diary.

- Check your bank accounts once a week by phone or online to see how much money you have.

- Set aside a specific day and time each week to look over your own affairs.

- Attend seminars, read books, and listen to podcasts about how to make money. (Our biweekly Event Update often tells you about good events that can help you.) If you know more, it will be easier to decide what to do and do it.

- Setting up your finances for the future

This should be the most important thing. If you don’t do anything because you think it’s too hard, think about this.

What would happen if you lost your job, got hurt, and couldn’t work for six months? How would you provide for yourself and your family? Have you taken care of your insurance?

Where do you think you’ll be in five years? Maybe old and getting a pension? Or maybe you have a pension that you hope will be enough to support you? Too many people think that superannuation is the answer to a safe retirement, but they are mistaken.

Just hoping isn’t enough. You need to take the initiative to find people who can help you. But be careful about who gives you advice and why they are “selling” you, their ideas.

It’s important to learn how to make the most of the money you’ve worked hard for so you can build wealth. After all, if you don’t care about your financial future, who else does?

Taking charge of your own life will give you peace of mind and let you know that you are making things happen.

Someone once said, “Some people make things happen, some people watch things happen, and some people don’t know what happened.” What will you choose?