From Cash Flow To Budgeting: Small Business Finances Made Easy

Running a small business can be an exciting and rewarding experience, but it is not without its challenges. One of the most difficult challenges for small business owners is successfully managing their finances. There are numerous moving components to consider, ranging from cash flow to budgeting. Small business finances, on the other hand, can be made simple with the correct approach. In this article, we’ll look at some tips and strategies for confidently managing your small business finances.

Cash flow is essential to the survival of any small business. It can be challenging to keep the lights on and pay the bills without a consistent source of income. As a result, it’s critical to monitor your cash movement on a regular basis. A financial flow statement is one method for accomplishing this. This document records the money that enters and exits your business, enabling you to see your cash position at a glance.

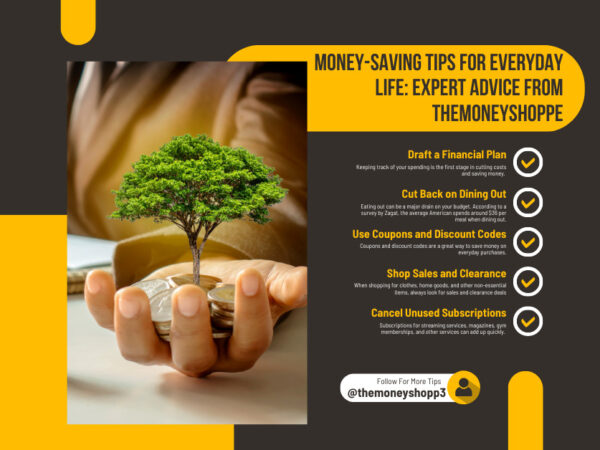

A budget for your small business is essential in addition to tracking your cash flow. A budget assists you in budgeting your spending and ensuring that you have enough money to pay your expenses. Begin by identifying your fixed expenses, such as rent, utilities, and salaries, when establishing a budget. Then, consider your variable costs, such as inventory and promotion. You can find places where you can cut costs or invest more money once you have a clear picture of your expenses.

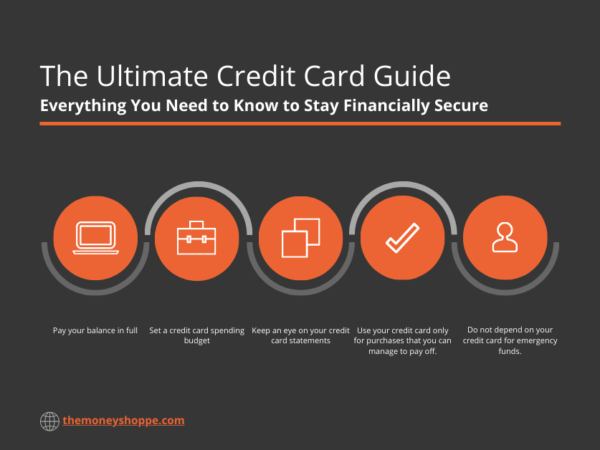

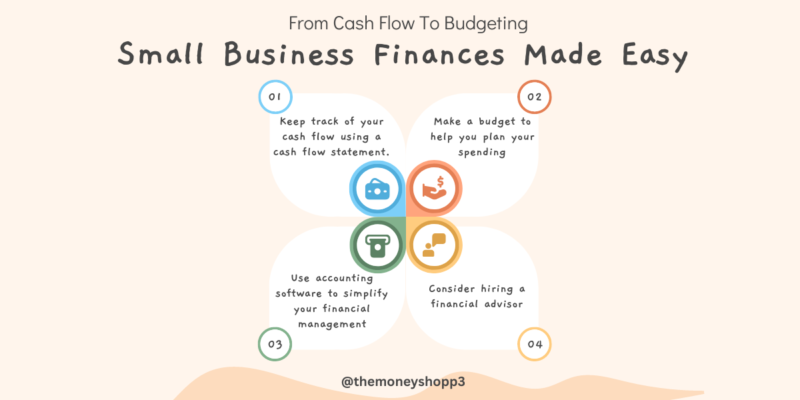

Managing the finances of your small business can appear overwhelming, but it doesn’t have to be. You can take charge of your finances and position your business for success by following a few simple steps. Here are a few tips to get you started:

- Keep track of your cash flow using a cash flow statement.

- Make a budget to help you plan your spending and make sure you have enough money to pay your expenses.

- Accounting software can help you simplify money management and streamline your operations. And one of the best accounting software you can get in the market is the THECASHROCKET

- Hire a financial advisor or accountant to assist you in navigating complex financial problems.

Now that you have a greater understanding of how to manage your small business finances, it’s time to take action. Begin by developing a cash flow summary and a budget for your business. Use accounting software to make financial management easier, and seek expert help when necessary. With these tools and strategies at your disposal, you’ll be better prepared to make sound financial choices and position your business for long-term success.