In today’s digital age, protecting your finances is more important than ever. Scammers and fraudsters have discovered new and sophisticated ways to target unwary people as technology has advanced. The risks range from phishing emails to investment schemes and are constantly evolving. To protect your hard-earned cash, you need a solid strategy to guide you through understanding and adopting critical financial security measures.

Being aware of potential hazards is the first step in protecting your finances. Scammers employ a variety of methods to obtain your personal information and money. These threats might come in the form of unsolicited emails, phone calls, text messages, or even face-to-face interactions. Here are some examples of frequent scams to avoid:

- Phishing Emails: Scammers often impersonate legitimate organizations to trick you into providing sensitive information. They send emails that appear genuine, asking for personal details or login credentials.

- Impersonation Scams: Fraudsters may pose as government agencies, financial institutions, or well-known companies, creating a sense of urgency to manipulate you into giving them money or information.

- Investment Scams: Be wary of promises of high returns with little to no risk. Scammers often use enticing investment opportunities to lure victims into parting with their savings.

- Tech Support Scams: You might receive a call from someone claiming to be from a tech support company, alleging that your computer has a virus. They’ll ask for remote access to your computer and charge you for unnecessary services.

Understanding the potential implications of falling prey to scams and fraud is critical to encouraging you to safeguard your cash. The consequences can be serious and long-lasting.

- Financial Loss: Scammers can drain your bank accounts, max out your credit cards, or steal your identity, leaving you with significant financial losses.

- Emotional Distress: Being a victim of fraud can be emotionally distressing, causing anxiety, depression, and stress as you deal with the aftermath.

- Legal Issues: In some cases, victims may face legal consequences if they unknowingly engage in illegal activities orchestrated by scammers.

- Damage to Reputation: Falling victim to a scam can harm your reputation, especially if personal or embarrassing information is exposed.

Now that you are aware of the risks and their effects, the next stage is to establish a strong desire to protect your finances. Here are some proactive ways to help you accomplish this:

- Educate Yourself: Stay informed about the latest scams and fraud tactics. Knowledge is your first line of defense.

- Verify Information: Always verify the authenticity of emails, phone calls, or messages from unfamiliar sources. Contact the organization directly using its official contact information.

- Use Strong Passwords: Create complex, unique passwords for your online accounts, and consider using a password manager to keep them secure.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for your accounts to add an extra layer of security.

- Be Cautious with Personal Information: Avoid sharing personal information, such as Social Security numbers or financial details, with unsolicited contacts.

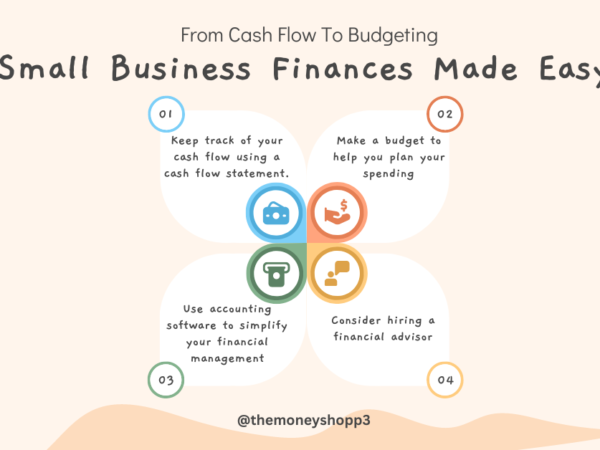

- Invest Wisely: Before investing, research the company or individual thoroughly and seek advice from trusted financial advisors.

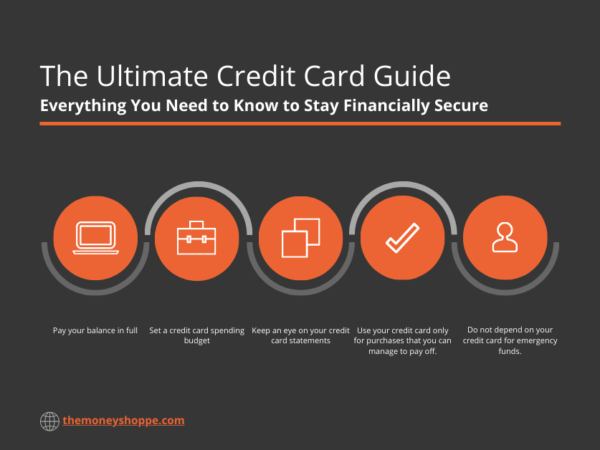

- Monitor Your Accounts: Regularly review your bank and credit card statements for any unauthorized transactions.

Taking action to safeguard your finances entails putting your plan into action. Here are some specific steps you may take to protect your financial well-being:

- Install Anti-Virus Software: Use reputable anti-virus and anti-malware software on your devices to protect against malicious software.

- Secure Your Wi-Fi Network: Set a strong password for your Wi-Fi network to prevent unauthorized access.

- Shred Sensitive Documents: Shred or securely dispose of financial documents, credit card statements, and bills before discarding them.

- Check Credit Reports: Regularly request and review your credit reports for any unusual or unauthorized activity.

- Report Suspected Scams: If you encounter a scam or fraudulent activity, report it to your local authorities and relevant regulatory agencies.

- Seek Legal Advice: If you’ve been scammed, consult with an attorney to understand your options for recovering lost funds or mitigating legal consequences.

- Educate Your Loved Ones: Share your knowledge about scams and fraud with family and friends to help protect them as well.

In today’s digital world, protecting your finances against scams and fraud is a critical obligation. You can significantly reduce your risk of falling victim to scams and fraud by paying attention to the threats, understanding the implications, establishing a strong desire to protect your assets, and taking action to adopt financial security measures. Stay alert, aware, and secure to ensure your financial security for years to come.