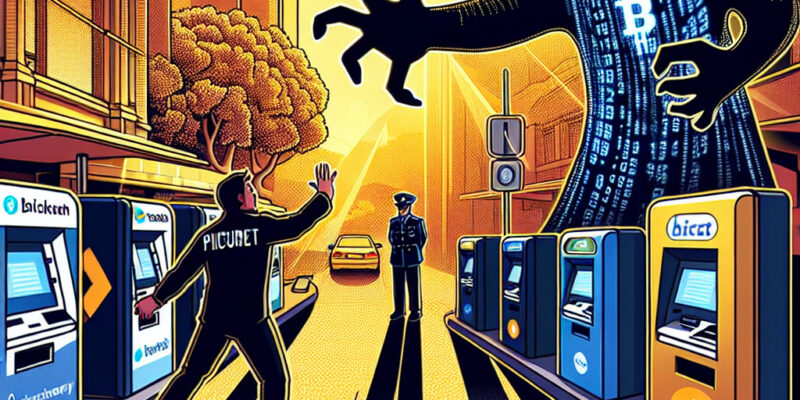

Australia Unleashes New Powers to Combat Crypto ATM Fraud

In a world where digital innovation continues to redefine financial landscapes, the allure of cryptocurrencies persists with stirring promise and unavoidable challenges. Yet, this promise comes with a darker shadow, as the threat of fraud and illicit financial activities loom ever-present in this budding digital domain. Recently, Australia has taken a resolute stand against these malpractices, introducing new measures aimed at curbing fraudulent activities associated with cryptocurrency ATMs.

Cryptocurrencies, lauded for their potential to democratize finance, have become an integral part of the global economic conversation. Alongside their appeal, these digital currencies also present opportunities for misuse, prompting governments worldwide to seek effective regulatory frameworks. In this context, Australia’s latest strategic move is not merely a reactionary measure but a thoughtful approach to safeguarding the integrity of its financial systems.

The genesis of these new regulations ties back to findings from AUSTRAC, the Australian government agency responsible for detecting and preventing criminal abuse of the financial sector. Their reports have shed light on troubling instances where cryptocurrency ATMs were implicated in schemes of fraud and money laundering. These revelations have catalyzed discussions around strengthening the monitoring and control of digital transactions conducted via these machines.

Cryptocurrency ATMs have grown in popularity, providing users with a convenient method for buying and exchanging digital currencies. They symbolize a bridge between traditional banking systems and the emergent, decentralized finance world. Yet, it is precisely this accessibility that can also be exploited. With AUSTRAC’s findings, the potential for exploitation became starkly clear, urging Australian authorities to act decisively.

The new powers granted to AUSTRAC enhance its ability to oversee and regulate cryptocurrency transactions more closely. This initiative seeks to ensure that cryptocurrency ATMs are not used as clandestine pathways for laundering illicit gains or defrauding unsuspecting users. By amplifying monitoring mechanisms, Australia aims to deter and dissect suspicious activities that might otherwise slip through the cracks of less vigilant systems.

It is worth exploring how these developments may influence the broader crypto atmosphere. Stricter regulations, while often seen as hindrances by purists, can also engender trust and stability within the ecosystem, potentially attracting more mainstream users who seek assurance of security in their digital transactions. Such measures could set a precedent globally, inspiring other nations to adopt similar stances, thus fostering a collaborative international effort against cybercrime.

Moreover, the dialogue around these changes underscores a delicate balance that regulators must maintain—one that encourages innovation while enforcing security. As governments around the world grapple with this paradox, Australia’s actions highlight a proactive approach, aiming to bolster the sector’s credibility without stifling its growth.

Reflecting on these developments invites a broader contemplation on the future of cryptocurrencies and digital finance. As the world witnesses rapid technological evolution, the question remains: How can we sustain the momentum of change while ensuring a safe and equitable financial future for all participants? Australia’s proactive measures might just be a part of the answer. They beckon a future where digital currencies can thrive under vigilant watch, crafting a narrative that responsibly bridges the old and the new.