The Ultimate Credit Card Guide: Everything You Need to Know to Stay Financially Secure

Credit cards have become an essential component of modern living. They provide convenience, flexibility, and the ability to access money as needed. They can, however, cause financial ruin if not used properly. That is why we have developed the ultimate credit card guide to help you in staying financially secure.

You may question why you need a credit card in the first place. Isn’t it, after all, just a means to spend money you don’t have? While credit cards can be abused, they also provide numerous advantages that can help you achieve financial security.

Credit cards, for example, can help you establish credit. Your credit score reflects your creditworthiness and is used by lenders to decide whether or not to approve your loan, credit card, and other financial product applications. You can improve your credit score over time by using your credit card wisely and paying your bills on time, which will make it easier for you to get accepted for loans and credit in the future.

Furthermore, credit cards provide rewards and perks that can help you save money. Many credit cards provide cashback, vacation rewards, or points that can be redeemed for merchandise, which can build up to substantial savings over time.

The expense of borrowing money from the card issuer is referred to as credit card interest. When you carry a credit card balance, you will be charged interest on that balance, which can rapidly add up if you are not careful.

The interest rate on your credit card varies based on the card issuer and your creditworthiness. In general, the higher your credit score, the cheaper your interest rate. Even if you have a high credit score, you will be charged interest on any balances you carry.

To prevent paying interest on your credit card balances, try to pay them off in full each month. If you are unable to pay your debt in full, try to pay as much as possible to reduce the amount of interest charged.

With so many credit card options available, it can be difficult to select the best one for you. However, by considering your spending habits and financial goals, you can discover the best credit card for your needs.

First, consider your spending patterns. Do you spend a lot of money on food, gas, and travel? In those areas, look for credit cards that offer rewards or cashback. If you have a credit card balance, search for one with a low-interest rate to reduce your interest charges.

Consider your money objectives next. Do you want to improve your credit? Look for a credit card that sends information to all three credit agencies and provides tools to help you monitor and improve your credit score. Do you want to save money? Choose a credit card with no annual charge and rewards that correspond to your spending habits.

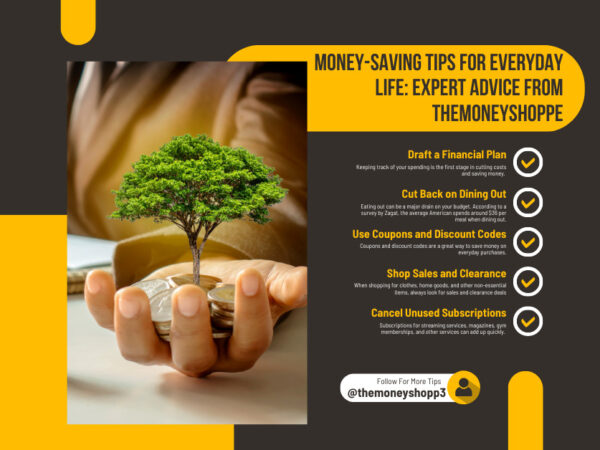

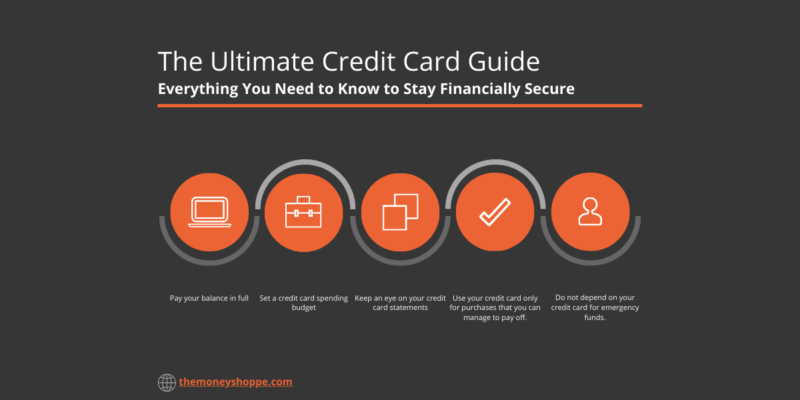

Now that you have a better grasp of credit cards, it is critical to know how to use them responsibly in order to maintain financial security. Here are some guidelines to help you make good use of your credit card:

- Pay your balance in full each month to avoid paying interest.

- Set a credit card spending budget and stick to it.

- Keep an eye on your credit card statements for any unusual activity.

- Use your credit card only for purchases that you can manage to pay off.

- Do not depend on your credit card for emergency funds.

By following these guidelines, you can use your credit card to your benefit while remaining financially secure.

Finally, credit cards can be an effective tool for building credit, receiving rewards, and obtaining funds when needed. However, in order to avoid falling into debt and damaging your credit score, you must use them carefully. You can remain financially secure and make the most of your credit card by understanding how credit card interest works, selecting the right credit card for your needs, and using your card wisely.

Keep in mind that credit cards are only one component of your total financial picture. It is also critical to have a budget, save for emergencies, and spend for the future. You can accomplish financial security and reach your financial goals by approaching your finances holistically.