Money-saving tips for everyday life: Expert advice from TheMoneyShoppe

One of the most crucial elements of financial security is the ability to save money. Finding methods to save money in your daily life can make a significant impact, whether your goal is to reduce debt, increase savings, or simply live a more frugal lifestyle. Luckily, there are a number of easy things you can do to reduce costs and make your money go further. In this article, we will discuss some money-saving strategies recommended by TheMoneyShoppe.

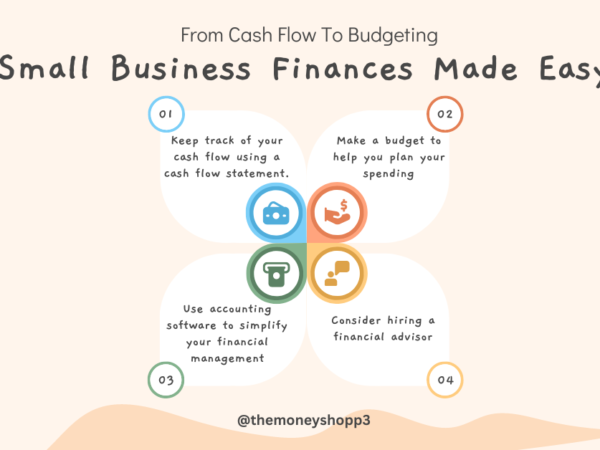

Create a Budget

Keeping track of your spending is the first stage in cutting costs and saving money. You can keep tabs on your spending and find places to save money by making a budget. First, tally up your regular monthly outlays for everything from housing costs to food, transit, and recreation. Finally, monthly savings can be calculated by deducting costs from revenue. The leftover cash can then be put toward debt reduction or investments.

Cut Back on Dining Out

Spending a lot of money on eating out is a common problem. It costs about $36 for the typical American to eat out, according to a study by the restaurant rating website Zagat. Spending over $1,000 per month on eating out is not uncommon. Try preparing more meals at home. Time and money can be saved without sacrificing quality when it comes to preparing healthy, delicious meals by using a menu planner and cooking in bulk.

Use Coupons and Discount Codes

You can save a lot of money on regular transactions by using coupons and promo codes. Check coupon sites like RetailMeNot, Coupons.com, and Groupon before making a buy. Apps like Honey and Rakuten allow you to scan items in a store’s virtual aisles to discover discounts.

Shop Sales and Clearance

Always keep an eye out for discounts and sales when purchasing clothing, furniture, and other non-essential things. Extreme markdowns are common for overstocked or out-of-season goods at many stores. You can save even more money if you shop for clothes and other necessities during the off-season. You can save as much as 70 percent on winter apparel if you shop for it in the spring or summer, for instance.

Cancel Unused Subscriptions

The costs of various subscription services, such as media streaming, print publications, and fitness centers, can rapidly add up. Check your monthly memberships and drop the ones you aren’t using. Another option is to bargain with service providers for a reduced fee or to switch to a service that costs less.

DIY Your Home Maintenance

It can be pricey to hire an expert to take care of repairs and upkeep at home. Instead, you should attempt to handle routine upkeep and repairs on your own. From how to repair a dripping faucet to patching drywall, you can find detailed directions on YouTube and other online resources.

Use Public Transportation or Carpool

It’s no secret that for many individuals, transportation costs are among the highest. If you have access to reliable public transit, ditch the car and save money. If you want to cut down on gas costs and vehicle maintenance, carpooling with friends or colleagues is a great option.

Buy Generic Products

In many cases, generic or store-brand alternatives are superior to their more expensive branded equivalents. You can save as much as thirty percent or more on food, hygiene products, and other necessities by opting for the generic brand. Store-brand versions of clothing, house furnishings, and electronics are frequently less expensive than their name-brand counterparts, and many retailers offer both.

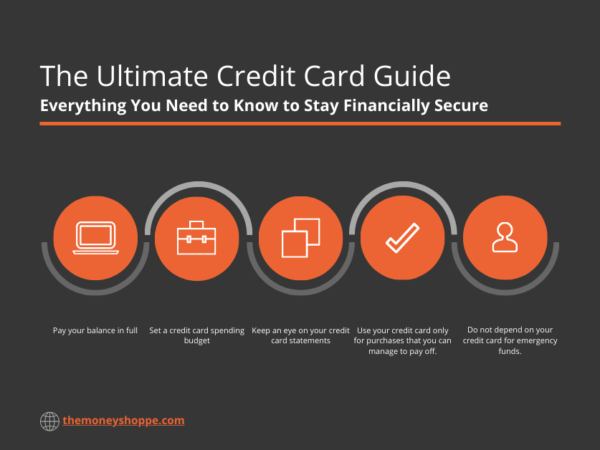

Negotiate Bills and Fees

The likes of cable and internet providers, credit card firms, and insurance agencies are all likely to be amenable to negotiating fees and rates. Ask your service provider for a better rate before renewing a contract or arrangement. It’s possible that you’ll be pleasantly pleased by how much money you can put aside.

Use Cashback Apps

Apps like Ibotta and Checkout 51 offer cash back on everyday transactions like groceries and household goods. Using the app’s receipt scanning or loyalty card linking features, users can easily accumulate points toward cash incentives. Once you’ve accumulated enough points, you can trade them in for cash or merchandise.

Reduce Energy Usage

If you can cut back on your energy consumption, you can lower your annual utility costs. Over time, even small changes like turning off lights when you leave a room, switching to energy-efficient light bulbs, and turning off devices when they’re not in use can have a significant impact on your utility bills. To reduce heating and cooling expenses, you can also attempt turning the thermostat up or down by a few degrees.

Use Free Entertainment Options

Although spending money on amusement can quickly add up, there are plenty of choices that won’t break the bank. You can get free books, movies, and music by visiting your neighborhood library. Attend free local activities like festivals and concerts. Hiking and bicycling are great ways to get some fresh air and exercise without spending a lot of money.

Comparison Shop

Never buy a large ticket object like an appliance, electronic device, or piece of furniture without first doing some comparative shopping. To find the best deal and the most user-friendly retailer, use websites like PriceGrabber and Google Shopping. Try bargaining with the vendor for a lower price or inquiring about price-matching options.

DIY Your Beauty Routine

Expensive beautification services like haircuts and manicures are just two examples. Do them yourself to save money instead of hiring a professional service. You can learn how to do anything from giving yourself a manicure to cutting your own hair with the help of tutorials on YouTube and other online tools.

MSI GeForce RTX 3070 Ti GAMING X TRIO 8G Gaming Graphics Card

Buy Used Items

You can save a lot of money on everything from apparel to furniture by purchasing it secondhand. You can find great bargains on lightly used items by shopping at thrift stores, consignment shops, and online marketplaces like Craigslist and Facebook Marketplace. If you need some extra cash, you can always try selling your own personal things on eBay.

Finally, there are many easy things you can do to reduce your daily spending and save money. You can reach your financial objectives by making a budget, cutting back on eating out, using coupons and discounts, and taking advantage of sales and clearance deals. You can save even more money by following other money-saving strategies, such as canceling unused subscriptions, performing house maintenance yourself, taking public transit or carpooling, and purchasing generic brands. A more secure financial future can be yours with just a few adjustments to your current spending patterns.