How to Cut Costs When You’re Stuck in a Tight Spot

If you are in the midst of changing careers with limited financial reserves or are up to your neck in alligators as a result of excessive spending, you should run to the problem rather than away from it. The longer you continue to lug around this problem, the heavier it will get. Make the decision to put into action each of the ideas listed below in order to cut your expenses starting right away. Make it a challenge to see how low you can lower your spending, and you could just discover that less is more. Even better, make it a game.

- Find a long-distance carrier that has a low per-minute pricing and does not charge a monthly subscription.

- Cancel all periodicals, including newspapers, magazines, and other publications. There is no need to spend any money because the library, the internet, and television are all readily available to you at no cost.

- Increase your medical coverage deductible, buy generic prescriptions whenever possible, and get the best price by calling around to different local pharmacies and comparing prices. If you want to be a smart consumer of health care services and save money at the same time, read and understand your medical plan.

- Streamline, declutter, and simplify the environment in which you live. You should have a garage sale and fill it with things you don’t use, don’t have room to display, or are unable to get to quickly or easily. You could also think about selling the items on the website eBay. You also have the choice of donating the items to a charitable organization, which may allow you to take a tax deduction for your contribution. Someone else is going to find value in the things you own.

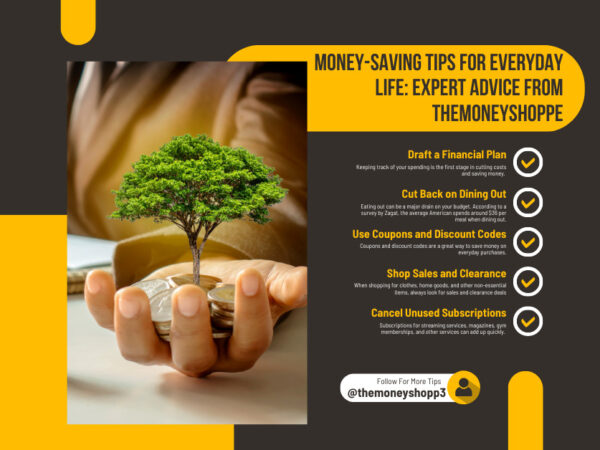

- If you are employed, you should bring your lunch, shop at a grocery store that offers discounts and buy in bulk, stop eating junk food, steer clear of purchasing premade meals, and steer clear of dining out for dinner. Have you given any thought to the possibility that your daily latte could end up costing you as much as $600 a year?

- Cancel your membership at the fitness center. Try walking, running, hiking, or biking. It is much simpler and more convenient to begin exercising the moment you step through the door of your home; in addition, beginning your workout outside in the fresh air is energizing.

- Instead of going to the theater, you may relax at home with a good book, rent a video or DVD, or watch a movie online. Make your own popcorn, settle into your most comfortable chair, and enjoy a relaxing evening in the comfort of your own home.

Money problems rarely have to do with money. Instead, they come from the way you live.

If you’re having money problems or can see them coming, don’t try to find reasons to spend more.

Instead, cut every expense you can right now, and when you’re out of debt, start saving and build up at least a year’s worth of money. It’s possible! Good luck.