5 Hidden Money Leaks and How to Plug Them Today

The art is not in making money but in keeping it.

You’re earning more. Hustling harder. Maybe even budgeting. And yet… your savings account is suspiciously stagnant. Where’s it all going?

Here’s the truth: most people aren’t sabotaged by huge expenses. They’re tripped up by tiny, invisible money leaks—the kind that quietly bleed your finances month after month.

Not because you’re careless. But modern life is full of financial “drips” that don’t look like problems until you add them up. That’s what this post is here for: to help you plug the leaks, reclaim control, and make every dollar work like it actually wants to stay in your wallet.

These aren’t your typical “stop drinking coffee” tips. These are practical, high-impact moves designed to free up serious cash — without feeling like you’re cutting back on everything you enjoy.

Let’s plug those leaks.

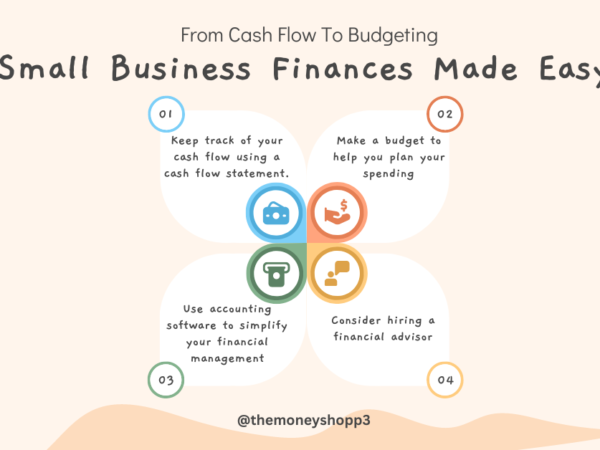

Subscriptions You Forgot You’re Paying For

A 2023 survey by C+R Research found that 74% of people underestimate how much they spend on subscriptions. Between streaming platforms, mobile apps, gym memberships, and “free trials,” it’s easy to spend hundreds a year on things you barely use—or forgot you even had.

🛠 Fix it:

- Search your inbox for the words “subscription” or “invoice.”

- Log in to your banking app and review the last 90 days for recurring charges.

- Cancel what isn’t serving you. Be ruthless. If you want it again, you can resubscribe.

Daily Habits That Feel Cheap (But Aren’t)

One latte. One quick lunch. One Lyft ride. Feels harmless, right?

Now multiply that by 22 workdays a month. That’s how a $15 lunch habit becomes a $330 leak.

🛠 Fix it:

- Choose one high-frequency purchase to swap each week (e.g. bring lunch 3x weekly).

- Set a weekly “convenience spending” limit and track it like a mini-budget.

💡 Pro Tip: Framing the swap as a challenge (“$100 DIY coffee month”) keeps it fun instead of feeling restrictive.

Inefficient Energy Use at Home

Your electric bill isn’t just reflecting your lifestyle—it’s punishing inefficiency. Leaky windows. Lights left on. Appliances are running on standby. These add up to hundreds per year in wasted energy costs.

🛠 Fix it:

- Unplug devices when not in use (or use a smart power strip).

- Install a programmable thermostat and set a schedule.

- Replace bulbs with LEDs—yes, every single one.

- Run big appliances during off-peak hours.

💡 Pro Tip: Check with your utility company for a free energy audit—they’ll often identify savings you didn’t even know were possible.

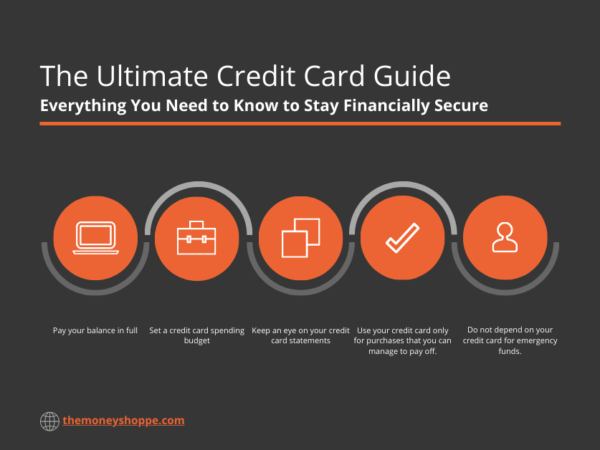

Wasting Credit Card Perks or Paying Interest

Are you earning rewards—or funding your card issuer’s bonus pool?

If you’re not leveraging the perks of your credit cards, or worse, carrying a balance, you’re leaving money on the table and paying more for the privilege.

🛠 Fix it:

- Review your credit cards. Are the rewards aligned with your lifestyle (travel, groceries, gas)?

- Pay off the balance in full every month. No exceptions.

- Redeem rewards regularly—don’t hoard them!

💡 Pro Tip: Call your card issuer and ask if there’s a better rewards card they can upgrade you to without a hard inquiry.

Bank Fees Hiding in Plain Sight

You might be getting charged for having too little money. Irony? That’s $12–$35 fees for overdrafts, monthly maintenance, ATM withdrawals, or even paper statements.

🛠 Fix it:

- Switch to a fee-free online bank or local credit union.

- Set up automatic alerts for low balances or large withdrawals.

- Link your savings as overdraft protection (if fees are waived).

💡 Pro Tip: Read the bank’s fee schedule—it’s long, but it’s your money. Better yet, choose a bank that doesn’t even have one.

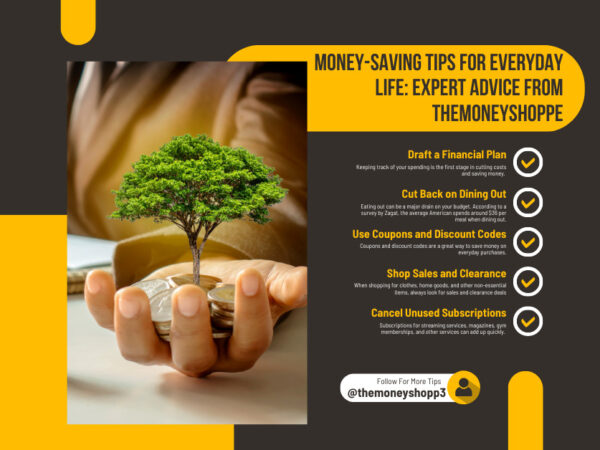

Wrap-Up: Small Fixes, Big Financial Impact

Here’s the thing: most leaks are invisible until they aren’t. And when you start plugging them, the results compound—fast. That’s what builds momentum. That’s how you make your money stick.

🔍 Next step:

- Pick one leak from this list.

- Take 15 minutes today to start fixing it.

- Rinse. Repeat.

Plugging leaks isn’t frugal. It’s smart money management. Let’s make sure your dollars are going where you want them—not slipping away without permission.